Optimizing short-term finance for business growth is crucial for maintaining cash flow, managing expenses, and ensuring that a company can invest in opportunities that drive growth. Here are some strategies to help optimize short-term finance for business growth:

1. Manage Cash Flow Effectively:

- Monitor Cash Flow: Regularly track cash inflows and outflows to anticipate periods of cash surplus or deficit.

- Optimize Payment Terms: Negotiate favorable payment terms with suppliers (e.g., extended payment terms) and encourage customers to pay promptly (e.g., offering discounts for early payments).

- Control Expenses: Identify areas where you can cut costs without compromising quality and efficiency.

2. Improve Accounts Receivable:

- Incentivize Early Payments: Offer discounts for customers who pay their invoices early.

- Follow Up Promptly: Send reminders for outstanding invoices and follow up promptly on late payments to improve cash flow.

3. Utilize Lines of Credit:

- Maintain a Line of Credit: Having a line of credit available can provide a safety net for managing short-term financing needs.

- Use Credit Wisely: Use credit facilities strategically and only when necessary to finance operations or investments.

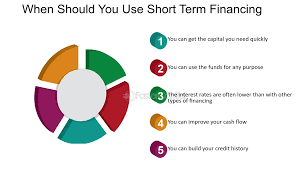

4. Short-Term Financing Options:

- Short-Term Loans: Consider short-term loans for immediate financing needs. Compare rates and terms to find the most suitable option.

- Invoice Financing: Use invoice financing to get immediate cash flow from unpaid invoices, rather than waiting for clients to pay.

5. Inventory Management:

- Optimize Inventory Levels: Manage inventory efficiently to reduce carrying costs and free up cash for other needs.

- Implement Just-In-Time (JIT): Consider a JIT approach to inventory management to keep stock levels lean.

6. Budgeting and Forecasting:

- Create a Budget: Develop a detailed budget for short-term financial planning to guide spending and investment.

- Perform Regular Forecasting: Use forecasting to anticipate future cash flow and financial needs, helping you make informed decisions.

7. Monitor and Reduce Debt:

- Monitor Debt Levels: Keep an eye on short-term debt levels to ensure they remain manageable.

- Refinance or Consolidate Debt: If possible, refinance high-interest debt or consolidate multiple debts to lower interest rates and improve cash flow.

8. Use Technology and Automation:

- Accounting Software: Use accounting and financial management software to track and manage finances more efficiently.

- Automate Billing and Invoicing: Streamline accounts receivable with automated billing and invoicing systems.

9. Optimize Supplier Relationships:

- Negotiate Better Terms: Work with suppliers to negotiate better payment terms and discounts.

- Build Strong Relationships: Maintaining good relationships with suppliers can help you negotiate favorable deals.

10. Explore Government Incentives and Grants:

- Research Incentives: Look for government incentives, grants, or subsidies that could support short-term finance needs and business growth.

11. Cost Management and Reduction:

- Regularly Review Expenses: Conduct a regular review of business expenses to identify areas for cost reduction.

- Outsource Non-Core Functions: Outsource non-core functions, such as payroll or IT support, to reduce overhead costs and increase efficiency.

12. Investment in Employee Development:

- Train Employees: Invest in employee training to increase productivity and reduce errors that can lead to financial losses.

- Cross-Train Staff: Cross-train employees to perform multiple roles, allowing you to reallocate staff where needed.

13. Short-Term Financial Reserves:

- Build a Financial Cushion: Maintain a cash reserve to buffer against unexpected expenses or revenue shortfalls.

- Set Financial Goals: Establish clear short-term financial goals to help guide investment and spending decisions.

14. Leverage Discounts and Promotions:

- Offer Limited-Time Promotions: Increase sales by offering limited-time promotions or discounts to stimulate customer interest.

- Negotiate Bulk Discounts: Negotiate with suppliers for bulk discounts on materials or services to lower costs.

15. Optimize Pricing Strategies:

- Review Pricing Regularly: Adjust pricing based on market demand and competition to maximize revenue.

- Bundle Products/Services: Offer bundled products or services to increase average transaction value.

16. Diversify Revenue Streams:

- Explore New Markets: Look for opportunities to expand into new markets or customer segments.

- Add Complementary Products/Services: Diversify your offerings to provide customers with more options and generate additional revenue.

17. Partnerships and Alliances:

- Form Strategic Partnerships: Collaborate with other businesses or organizations to share resources and expand your reach.

- Explore Joint Ventures: Consider joint ventures with complementary businesses to leverage each other’s strengths.

18. Cash Flow Analysis:

- Perform Regular Analysis: Regularly analyze cash flow statements to identify trends and areas for improvement.

- Identify Seasonal Fluctuations: Understand and plan for seasonal fluctuations in revenue and expenses.

19. Tax Planning and Compliance:

- Stay Current on Tax Laws: Keep up to date with tax laws and regulations to take advantage of tax benefits and avoid penalties.

- Plan for Tax Payments: Set aside funds throughout the year to cover estimated tax payments.

20. Financial Advisory and Consultation:

- Consult Financial Experts: Seek advice from financial professionals to develop strategies for optimizing short-term finance.

- Stay Informed: Stay informed about industry trends and changes in the financial landscape.

Conclusion:

By implementing these strategies and consistently reviewing and adjusting your approach, you can optimize short-term finance to support business growth. Effective management of short-term finances can help you seize opportunities, mitigate risks, and maintain financial stability for your business.